Interest and Depreciation Calculations Worksheets

What's the difference between simple interest and compound interest?

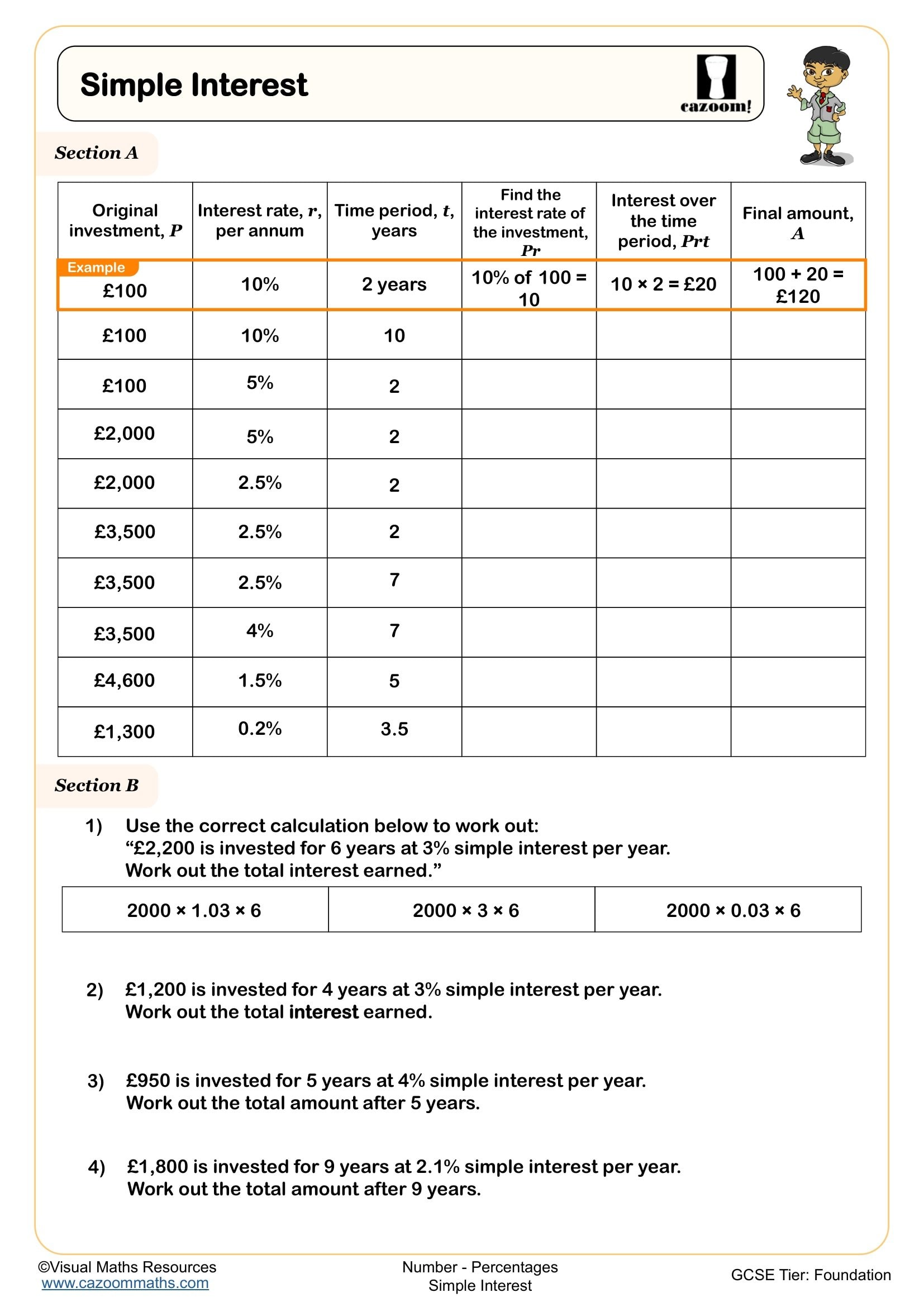

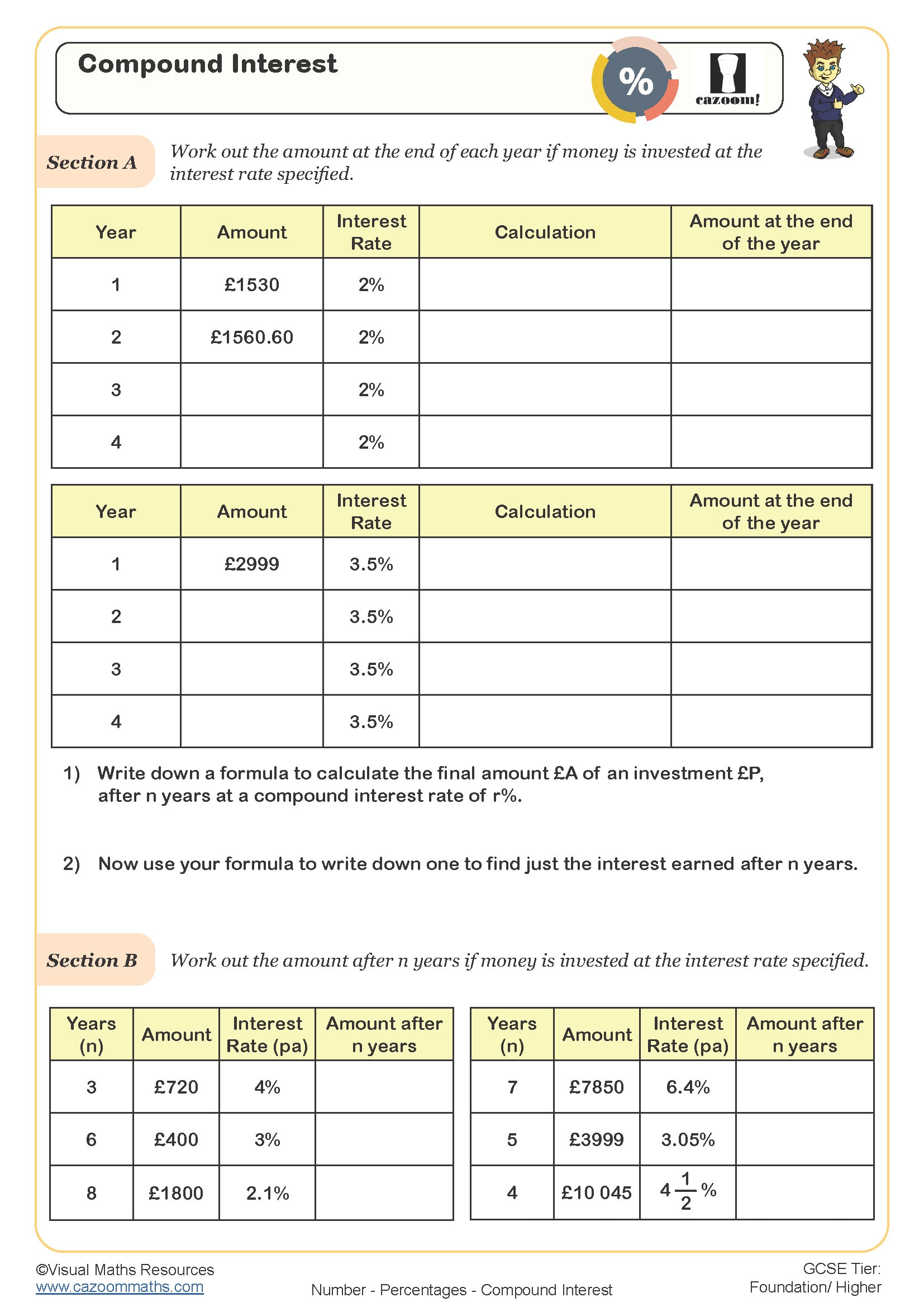

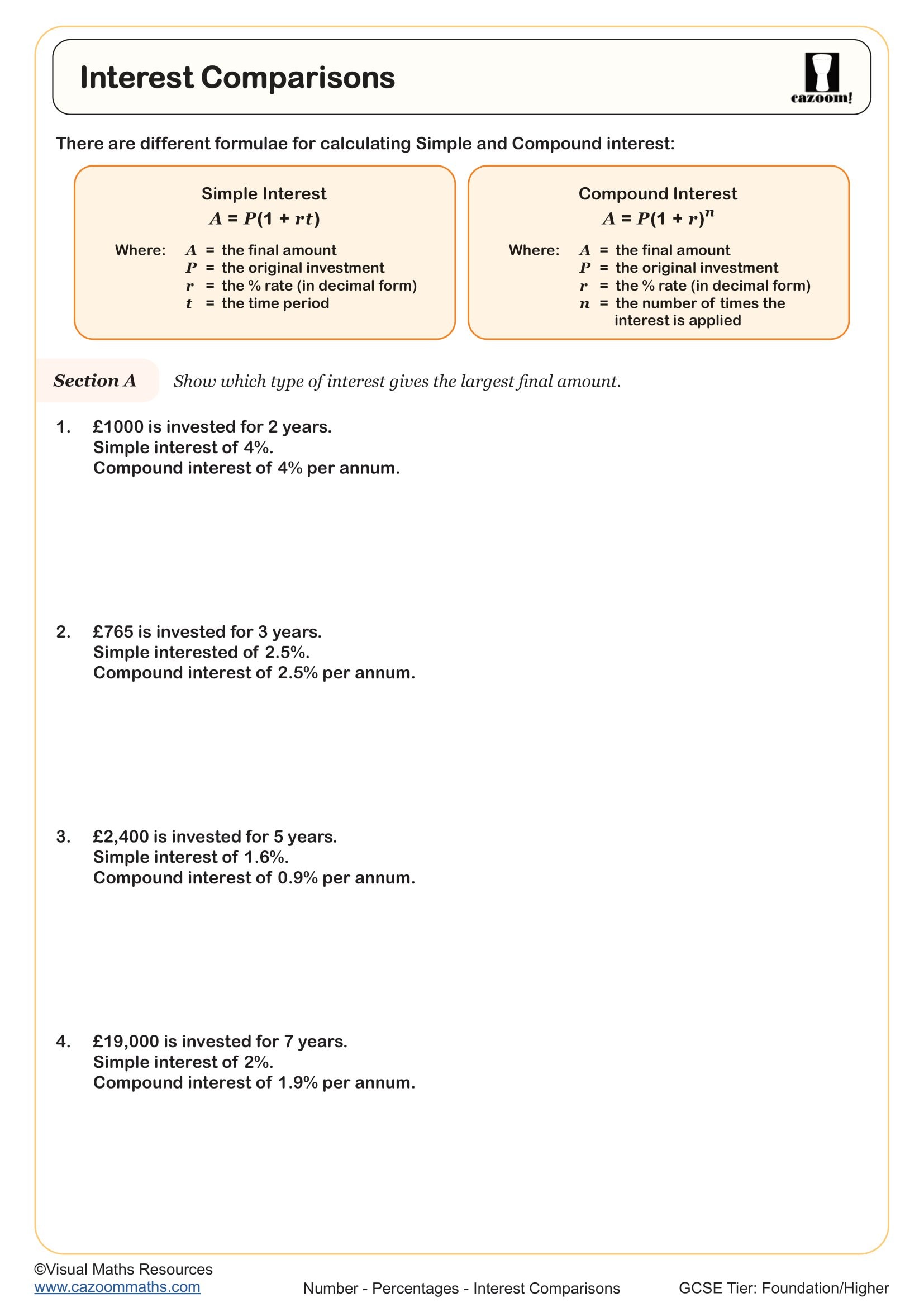

Simple interest calculates a fixed percentage of the original amount for each time period, whilst compound interest applies the percentage to the growing total, so interest earns interest. For example, £1,000 at 5% simple interest for 3 years generates £50 yearly (£150 total), but compound interest generates £50, then £52.50, then £55.13 (£157.63 total).

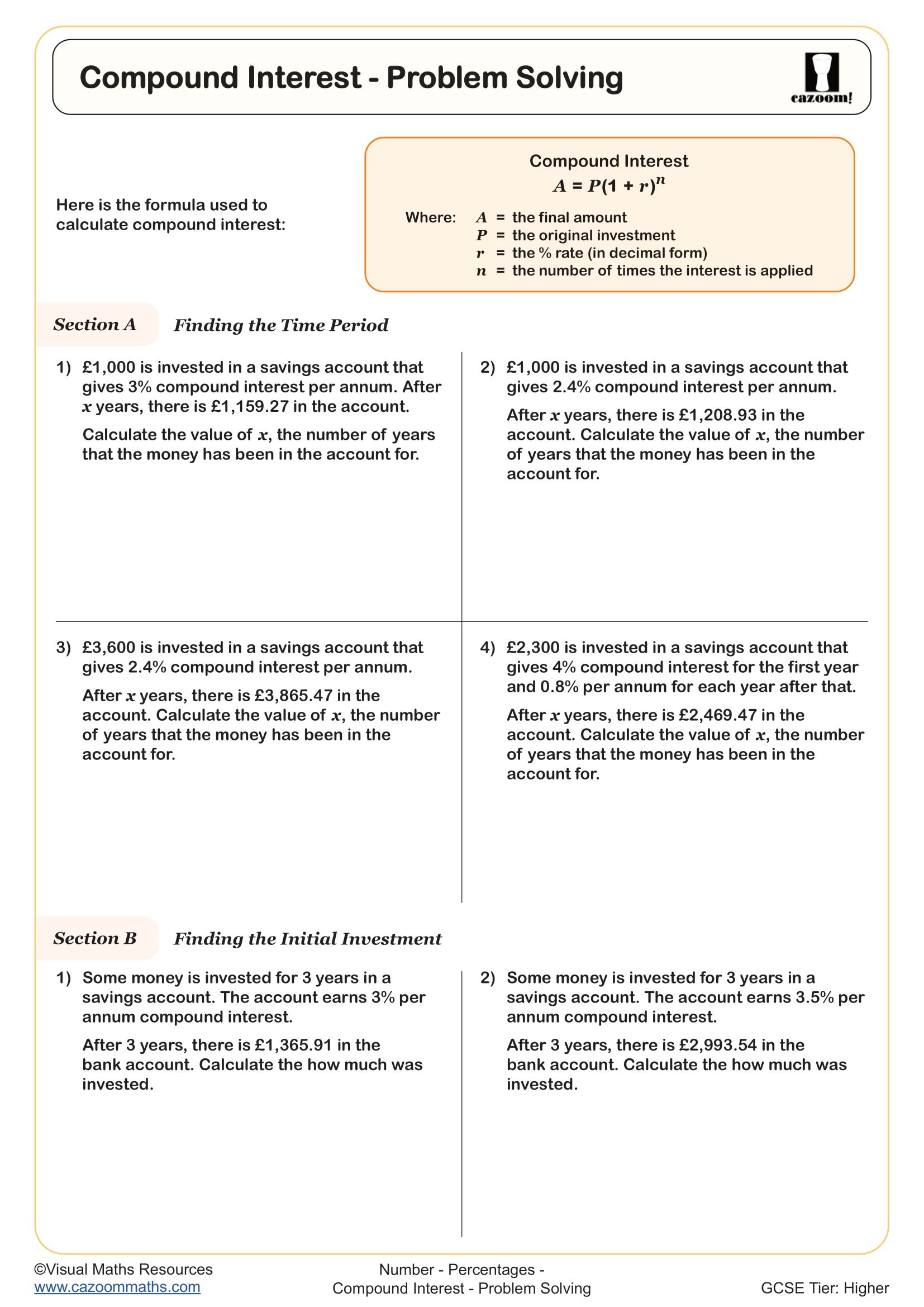

Students frequently lose marks by using multiplication when compound interest requires repeated percentage calculations or the multiplier method. The formula I × (1.05)³ handles compound interest efficiently, whereas simple interest uses I × 0.05 × 3, but many students mix these approaches. Exam questions deliberately test whether students recognise which type of interest applies from the context.

Which year groups study interest and depreciation calculations?

These worksheets cover Year 8, Year 9, Year 10, and Year 11, spanning KS3 foundation work through to GCSE preparation. The topic typically appears in Year 8 as an application of percentage increase and decrease, then develops into more sophisticated financial mathematics at KS4 where it connects to ratio, proportion, and exponential functions.

Progression moves from simple interest with whole number percentages to compound interest over multiple years, then introduces depreciation as repeated percentage decrease. Year 11 students encounter reverse problems (finding the original amount or interest rate) and questions combining appreciation and depreciation, which require stronger algebraic manipulation and understanding of inverse operations.

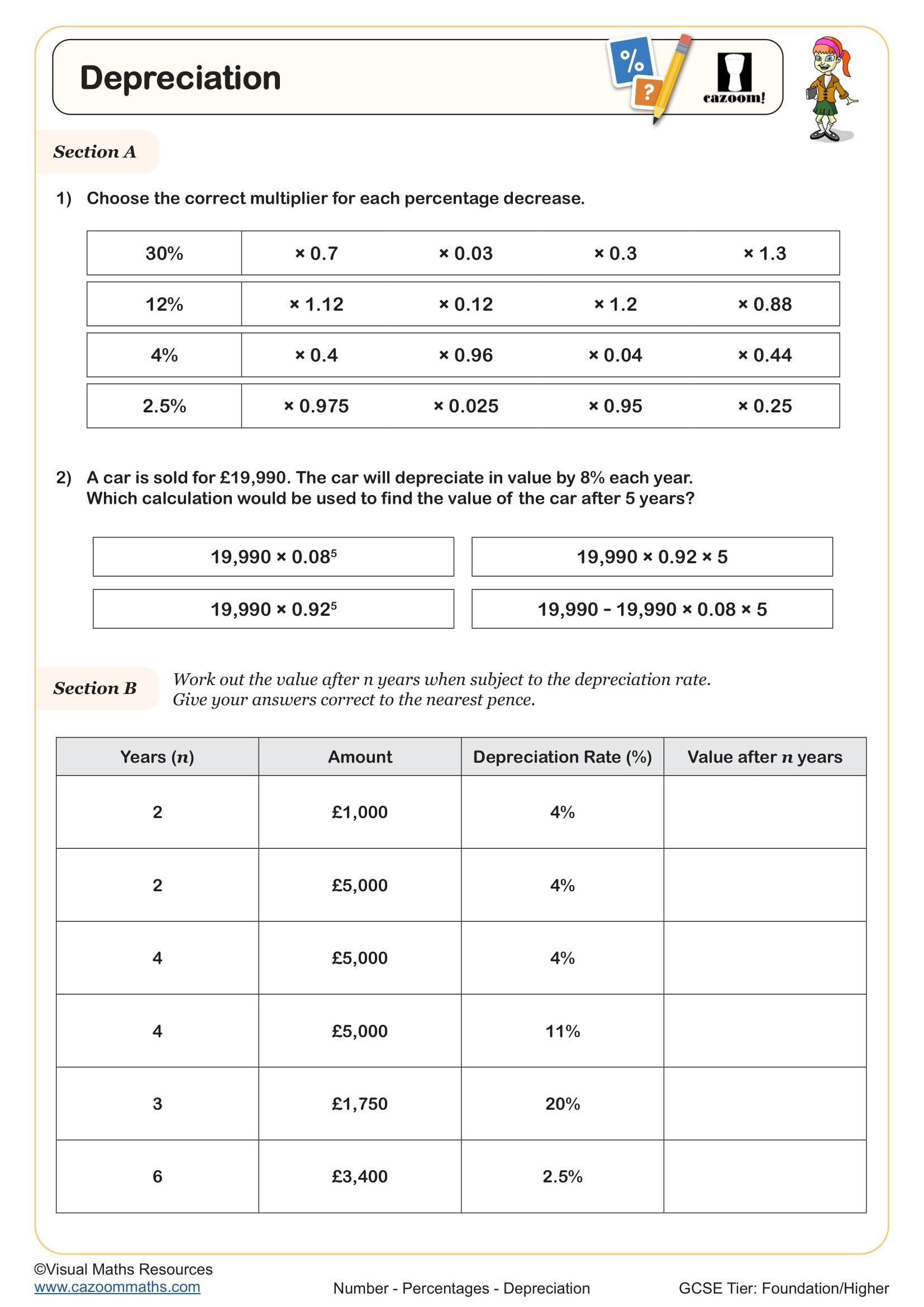

How does depreciation work in real-world contexts?

Depreciation represents how assets lose value over time through a repeated percentage decrease, calculated similarly to compound interest but reducing rather than increasing the amount. A car purchased for £18,000 that depreciates 15% annually is worth £18,000 × 0.85 after year one, then that result × 0.85 again, which simplifies to £18,000 × (0.85)ⁿ where n represents years.

This mathematics underpins business accounting, vehicle finance, and insurance valuations across industries. Engineers use depreciation calculations when budgeting equipment replacement cycles, whilst accountants apply these principles to determine tax write-offs for company assets. Understanding that a 15% annual decrease doesn't mean zero value after seven years challenges students' linear thinking and builds exponential reasoning needed for data science and economic modelling.

How do these worksheets help students master financial calculations?

The worksheets build from straightforward problems with clear time periods and percentages towards questions requiring students to identify the correct method from context, select appropriate formulas, and interpret multi-step scenarios. Worked examples demonstrate the multiplier method alongside repeated calculations, helping students see why (1.04)⁵ efficiently handles five years of 4% compound interest without calculating each year separately.

Teachers use these resources for targeted intervention when students struggle to connect percentage skills to financial contexts, or as homework following classroom introduction of compound interest formulas. The progressive difficulty within each worksheet makes them effective for mixed-ability teaching, whilst answer sheets enable students to self-check understanding during independent revision sessions before assessments. They work well for paired activities where students explain their method choice to partners, reinforcing mathematical reasoning.